BOARD MEETING DATE: November 5, 2010

AGENDA NO. 37

PROPOSAL:

Proposed Amendments to SOx RECLAIM Program (Regulation XX)

SYNOPSIS:

Proposed Amendments to Regulation XX RECLAIM will achieve additional SOx reductions pursuant to the 2007 AQMP Control Measure #2007CMB-02. The proposed amendments also address requirements for demonstrating Best Available Retrofit Control Technology equivalency in accordance with California Health and Safety Code §40440.

COMMITTEE:

Stationary Source Committee, June 20, 2008, June 19, 2009, November 20, 2009, May 21, 2010, July 23, 2010, and September 24, 2010, Reviewed. Refinery Committee, December 11, 2009, August 18, 2010 and September 22, 2010, October 14, 2010, Reviewed.

RECOMMENDED ACTIONS:

Adopt the attached resolution:

- Certifying the Final Program Environmental Assessment (PEA)

for Proposed Amended Regulation XX – Regional Clean Air

Incentives Market (RECLAIM); and

- Amending Proposed Rule 2002 – Allocations for Oxides of

Nitrogen (NOx) and Oxides of Sulfur (SOx).

Barry R. Wallerstein, D.Env.

Executive Officer

Background

Introduction The AQMD Board adopted the Regional Clean Air Incentives Market (RECLAIM) program in October 1993. The purpose of the RECLAIM program is to reduce NOx and SOx emissions through a market-based program. The program replaced a series of existing and future command-and-control rules and was designed to provide facilities with the flexibility to seek the most cost-effective solution to reduce their emissions. AQMD staff is proposing amendments to Regulation XX – RECLAIM to achieve additional SOx reductions pursuant to the 2007 AQMP Control Measure CMB-02 and state law.

Specifically, the proposed amendments address requirements for 1) Best Available Retrofit Control Technology (BARCT) in accordance with California Health and Safety (H&S) Code §40440, and 2) a demonstration of equivalency to command-and-control regulations, as required under H&S Code § 39616(c)(1). Reductions in SOx will help the Basin attain the federal annual average PM2.5 standard by 2015, and the federal 24-hour average standard by 2020. Other proposed rule amendments include clarifications and changes to the protocols.

Public Process

In a three-year rule development process for the proposed amendments from 2008-2010, staff conducted a Public Workshop on June 23, 2009; an Informational Governing Board Hearing on January 8, 2010, and a Public Consultation Meeting on September 8, 2010. Staff held numerous Working Group meetings with the stakeholders, as well as individual meetings with WSPA and the refineries to discuss issues related to the proposed amended rule. Staff presented its proposal at six Stationary Source Committee meetings and four Refinery Committee meetings for review. Staff released the first Preliminary Draft Staff Report in April 2008. At the June 23, 2009 Public Workshop, staff released the Draft Staff Report, the Notice of Preparation of the Draft Environmental Assessment, and the Draft Rule 2002. On August 18, 2010, staff released its Draft Program Environmental Assessment for a 45-day public review. On October 1, 2010, staff released its revised Draft Staff Report and the Socioeconomic Analysis for a 30-day public review. Regarding feasibility and cost analyses, in 2008-2009, staff contracted two consultants, ETS, Inc. and NEXIDEA to conduct independent feasibility and cost analyses. In 2010, staff contracted a third consultant - Norton Engineering Inc. (NEC) - to review the first two consultants’ analyses. The consultants’ non-confidential reports are posted on the AQMD web page.

Affected Facilities

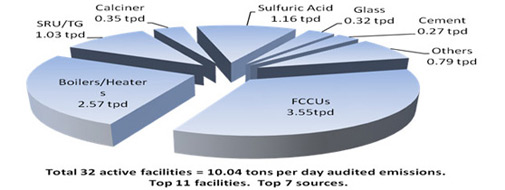

The proposed amendments will affect eleven major facilities: six refineries, a coke calciner, two sulfuric acid plants, a container glass manufacturing plant, and a cement plant. These eleven major facilities emitted 9.31 tons per day (93% of the total emissions from the SOx RECLAIM universe.) These eleven facilities hold 10.21 tons per day RTCs (87% of the total RTC holdings for the SOx RECLAIM universe.) The refinery sector accounted for 76 % of the total emissions and 73 % of the total available RTCs. Figure 1 [1] shows the emission distribution at these eleven facilities. The majority of the emissions was generated from seven categories of sources: 1) fluid catalytic cracking units; 2) sulfur recovery and tail gas treatment units; 3) refinery boilers and heaters; 4) sulfuric acid manufacturing plants; 5) container glass melting furnace; 6) coke calciner; and 7) cement kilns and a coal fired steam boiler at a cement manufacturing facility.

FIGURE 1 2005 Emission Distribution

[1] The 2005 audited emissions for the entire SOx RECLAIM universe were 10.04 tons per day. The total RTC Holdings for the universe are 11.77 tons per day.

Staff Proposal

BARCT Levels

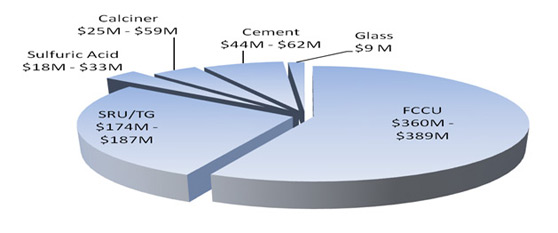

Table 1 shows staff’s proposed new BARCT levels, emission reductions estimated from 2005 baseline, and the average cost-effectiveness values estimated based on ETS/AEC’s and NEXIDEA’s recommendations (the first figure in the cost-effectiveness range), and Norton Engineering’s recommendations (the second figure in the cost effectiveness range.) Figure 2 shows the present worth values for the 25-year equipment life, estimated using the consultants’ input. The total investments were estimated to be approximately $630 millions to $750 millions dollars. The weighted average cost effectiveness spans between $16,000 per ton to $19,000 per ton SOx reduced for this project. The cost effectiveness for individual source categories ranges from $2,000 per ton to $50,000 per ton. It should be noted that WSPA strongly disagrees with the analyses performed by staff and the consultants.

TABLE 1

Staff’s Proposed New BARCT Levels

|

|

New BARCT |

Emission

Reductions(tons per day) |

Cost Effectiveness

($/ton) |

|

FCCUs |

5 ppmv |

2.88 |

20K - 21K |

|

SRU/TGs |

5 ppmv |

0.73 |

31K - 45K |

|

Sulfuric Acid |

10 ppmv |

1.03 |

2K – 3K |

|

Coke Calciner |

10 ppmv |

0.28 |

10K - 23K |

|

Container Glass |

5 ppmv |

0.19 |

5K |

|

Cement Kilns |

5 ppmv |

0.25 |

19K - 27K |

|

Coal Fired Boiler |

95% reduction |

0.00 |

4 K |

FIGURE 2

Present Worth Values (for 25

years) Based on Consultants’ Input (Excluding Cost-Ineffective Controls of >$50

K per Ton)

RTC Reductions

To implement the proposed BARCT levels, staff is recommending that RTC holdings be reduced by 5.7 tons per day or by 51.4 percent beginning 2012 through 2019. When fully implemented, these RTC reductions are expected to result in 5.4 tons per day actual emission reductions. This proposal differs slightly than the staff proposal released on October 1, 2010 and was crafted based on the latest available data and fully complies with all legal requirements.

The 5.7 tons per day RTC reductions will be distributed among the 11 major facilities, investors, and 3 facilities that have more RTCs holdings than originally allocated as of August 29, 2009. Staff proposes not to shave the RTC holdings of the 18 remaining facilities. Any RTCs traded after August 29, 2009 and prior to the Governing Board hearing date will be subject to the proposed shave levels to ensure that no RTC holdings are inappropriately traded or sheltered.

The 5.7 tons per day RTC reductions will be implemented in four (4) phases over eight (8) years. Staff will submit the first 4 tons per day of RTC reductions to EPA to satisfy the SIP commitment and help the Basin meet the standard in 2015, and will submit the remaining 1.7 tons per day at a later phase.

- Phase 1: 3.0 tons per day of reductions in compliance year 2013

- Phase 2: 4.0 tons per day of reductions in compliance year 2014

- Phase 3: 5.0 tons per day of reductions in compliance year 2017

- Phase 4: 5.7 tons per day of reductions in compliance year 2019

In an effort to ensure early reductions for the RECLAIM Program, facilities will be required to use SOx reducing catalysts in the FCCUs no later than July 1, 2011 to achieve a limit of 25 ppmv. The use of alternative controls is also allowed.

Safety Valves

To safeguard the successful implementation of the SOx RECLAIM program, several necessary “safety valves” are built in the proposed rule language: Staff is proposing set-aside RTC accounts (i.e. non-tradable/non-usable) equivalent to the RTC reductions called for by the specific compliance years that can potentially be made available to the impacted facilities in the event RTC prices exceed the $50,000 per ton threshold (discrete credit). Staff commits to monitor the 12-month rolling average RTC price and in the event the SOx RTC price exceeds $50,000 per ton, staff will report to the Governing Board at a public hearing to be held no more than 60 days from staff determination. At the public hearing, the Governing Board will decide whether or not to convert any portion of the non‑tradable/non-usable RTCs to tradable/usable RTCs and give that portion back to the facilities so that it can be used for compliance with the facility cap. In addition, staff will not submit any of the post-2015 emission reductions for inclusion into the State Implementation Plan until the reductions have been in effect for one full compliance year.

Key Issues

Although staff resolved most of the outstanding issues relative to the staff proposal the following discussion summarizes the key issues raised during the rule development phase by the stakeholders: 1) costs for compliance and BARCT determination, 2) BARCT determination for Owens-Brockway glass container manufacturing facility in Vernon; 3) water and wastewater, 4) market viability, and 5) shaving methodology for facilities that are not subject to new BARCT, and for facilities that are subject to new BARCT. Staff’s responses to these key issues are summarized below:

1) Costs for Compliance& BARCT Determination

As part of its proposal included in the Set Hearing Board Package released on October 1, 2010, staff proposed to reduce RTC by 6.1 tons per day (55% shave) representing 5.4 tons per day actual emission reductions by 2019. WSPA commented that staff should not pursue the 6.1 tons per day RTC reductions because WSPA estimated the cost of compliance with this shave to be $1.637 billion dollars, of which $836 million dollars would be for emission reductions under WSPA’s main strategy to comply with the “programmatic” BARCT, and $801 million dollars would be for “other” investments that must be implemented to achieve additional reductions within WSPA member facilities to comply with the 55% shave.

Staff’s Response: Staff has reviewed WSPA’s analysis and concluded that WSPA’s main strategy to meet the “programmatic” BARCT is reasonable. However, staff also concluded that WSPA’s assumption for an additional $801 million investment to implement “other” measures to meet the 55% shave would not be reasonable or necessary. Staff has identified cost‑effective off-site reductions which could be used to substitute for cost-ineffective on‑site controls as provided under a market-based cap-and-trade program such as RECLAIM. However, to provide additional margin of safety, staff is proposing to increase the compliance margin to 18.5% and reduce the shave from 55% to 51.4%. Summary of staff’s analysis is provided below.

WSPA’s Main Strategy.

Even though WSPA’s main strategy [2] is different than staff’s main strategy on an equipment-per-equipment basis, WSPA’s strategy would result in 3.81 tons per day actual emission reductions at a cost of $836 million and a cost-effectiveness of $24K per ton. In comparison, staff’s proposed main strategy would result in 3.92 tons per day actual emission reductions at a cost of between $561 million - $638 million and a cost-effectiveness of $16K - $18K per ton. On this basis, staff believes that the “programmatic” BARCT strategy proposed by WSPA is similar to staff’s proposal since it will achieve similar reduction levels through cost-effective measures.

[2] WSPA’s main

strategy includes 1) FCCUs would use 2 WGSs and SOx reducing additives to meet 5

ppmv – 35 ppmv; 2) SRU/TGs would use 2 WGSs and have process modifications to

meet 5 ppmv - 25 ppmv; 3) 1 WGS and other process modification at other units.

WSPA’s “Other” Strategies.

In its analysis presented to the Refinery Committee on October 14, 2010, staff concluded that the two “other” control strategies for a SRU/TG and fuel gas treatment proposed by WSPA at a cost-effectiveness of $213,000 per ton and $100,000 per ton would not be reasonable strategies to implement. However, two “other” strategies proposed by WSPA related to CEMS improvements and RTC holdings surrendered are very cost-effective at $1,686 - $6,805 per ton. The two “other” cost‑effective strategies amounted to $81 million dollars. With the main strategy and the two “other” cost-effective strategies in combination, WSPA members could achieve 5.31 tons per day reductions at $917 million and at an average cost-effectiveness of $18,925 per ton. However, WSPA members would only need 5.17 tons per day reduction to meet a 55% shave. Therefore, it is only reasonable to conclude that an investment of $917 million, not $1.637 billion estimated by WSPA, would be more than adequate to meet the proposed 55% shave and would generate 0.14 tons per day surplus RTCs. Nevertheless, to address concerns relative to safety margin, staff has modified its proposal to increase the compliance margin to 18.5% and reduce the shave from 55% to 51.4% which will provide facilities with additional flexibility and the ability to meet the proposed reduction target at less costs than those estimated above. In addition, staff estimated that there would be approximately 1.45 tons per day potentially available surplus RTCs[3] in the market from other sources after the 51.4% shave, which would raise the pool of surplus credits to 1.6 tons per day.

[3] The 1.47 tpd potentially available RTCs post-shave in the market comprised of:

- 0.21 tpd post-shave remaining unused RTCs (which is calculated as follows: The surplus RTCs estimated from the 2005 baseline are 1.73 tpd (11.77 – 10.04 = 1.73 tpd). WSPS already accounted for 1.30 tpd surplus RTC in their strategy, therefore the remaining unused RTCs are 1.73 – 1.30 = 0.43 tpd pre-shave and (0.43 tpd)(0.486) = 0.21 tpd post shave)

- 0.0009 tpd post shave hold by non-RECLAIM investors. (As of October 14, 2010, there are only two remaining investors that are non-RECLAIM facilities, and these two investors hold approximately 1,306 lbs of RTCs pre-shave or 0.002 tpd pre-shave or 0.0009 tpd post-shave.)

- 0. 60 tpd from non-refinery sector. (Assuming that the non-refineries would install control technologies proposed by either WSPA to meet the 51.4% shave; and would have surplus RTCs to sell in the market.)

- 0.66 tpd from refinery sector. (Assuming that the refineries would install control technologies proposed by either WSPA to meet the 51.4% shave; and would have surplus RTCs to sell in the market.)

2) BARCT Determination for Owens-Brockway Container Glass Facility in Vernon

Owens-Brockway commented that staff incorrectly determined the BARCT for glass melting furnaces. BARCT for glass melting furnaces should be at 80% not 95% (or 5 ppmv). Owens-Brockway commented that the packed bed scrubbers recommended would not work; the pressure drop introduced by the wet gas scrubbers was not considered; the costs of $225,000 to handle waste water stream were inadequate; other costs (e.g. CEMS, stack, permitting costs) were not included; and other analyses (e.g. NSR for other pollutants, Rule 1401 requirements) were not analyzed.

Staff’s Response:

Staff disagrees with the commenter. Staff’s feasibility analysis concludes that today’s BARCT is 5 ppmv (95% control efficiency or more). The proposed BARCT for glass facility has been achieved in practice at a container glass manufacturing facility in Seattle Washington. Relative to the control equipment configuration for the Owens-Brockway facility in the South Coast basin, the consultant (ETS) recommended the removal of the two dry scrubbers located upstream of the ESPs, and their replacement with two wet scrubbers (packed bed) positioned downstream of the ESPs. The ESPs located upstream of the packed bed scrubbers will be highly efficient in controlling particulate matter, and thus would provide protection for the packed bed scrubbers from clogging. In the consultant’s analysis, a fan was provided to overcome the pressure drop across the wet scrubbers and costs for a new stack were included. The cost effectiveness of this project is about $5,198 per ton SOx removed, and therefore other marginal additional costs such as adding new CEMS and permitting costs would not alter the project’s cost-effectiveness significantly. The consultant (ETS) estimated the equipment costs ($225,000) and annual operating costs for a waste water treatment based on information provided by Manufacturer D who cited from their relevant experience with a glass container facility in Seattle, Washington. Nevertheless, to address concerns expressed by Owens-Brockway and other facilities relative to additional margin for safety, staff has modified its proposal to increase the compliance margin to 18.5% and reduce the proposed shave from 55% to 51.4%. Relative to the issues such as NSR, staff recommends that they should be handled at the permitting phase not at the rule development phase of this project. Staff commits to help this and all other impacted facilities during permitting to ensure the successful implementation of this very important program. Staff would further like to remind the commenter that the District’s NSR Program (Regulation XIII) includes provisions that shields installation of pollution control equipment from the applicability of certain other NSR requirements.

3) Water & Wastewater Impacts

Stakeholders commented that the water and wastewater impacts of the project would be significant.

Staff’s Response:

Industry argued that staff proposal will result in significant increases on water demand and wastewater impacts due to the use of wet gas scrubbers. If wet gas scrubbers are used to comply with the proposed rule, staff estimated that the total water demand will increase by approximately 1 million gallons per day or 3 acre feet per day, but increased water demand over current water usage at affected facilities is well below the SCAQMD’s significance threshold of 5 million gallons per day of total increased water demand (i.e. potable water, recycled water, and groundwater). The information that staff received to date from the water purveyors and their 2005 Urban Water Management Plans is that there are adequate supplies to meet the total water demand, and use of recycled water is highly recommended if available. Relative to the wastewater impact, staff’s analysis indicates that the overall wastewater increase will be less than 2% and that the facilities have adequate wastewater treatment capacity to treat the increase, and no modifications to any existing wastewater discharge permits are anticipated. WSPA continues to strongly disagree with staff’s analyses.

3) Market Viability

Stakeholders commented that there were not enough trading partners, the SOx market was very competitive and reserved, and there was an uneven distribution of RTC holdings.

Staff’s Response:

For a market based incentive program, staff is required by the H&S codes to conduct periodic BARCT reassessment and demonstrate equivalency with command-and-control rules which would otherwise be developed as a result of BARCT reassessment. To ease the issues identified by the stakeholders, staff is proposing to return a portion of the reductions to the facilities as a compliance margin (18.5%). Similar approach was also utilized as part of the 2005 NOx RECLAIM amendments. Accounting for the fact that the SOx RECLAIM market is a lot less robust than the NOx RECLAIM market, staff is proposing a compliance margin of 18.5%. In addition, staff is proposing to establish a set-aside, non-tradable reserve that could be tapped in when RTC value in the open market reach a certain level. Staff believes that compliance with a facility cap still provides the facilities more operational flexibility than being subject to stringent requirements in command-and-control rules and regulations.

4) Shaving Methodology

Facilities with no equipment subject to new BARCT commented that the uniform shave was not equitable, would create significant difficulties for them to stay in compliance, and indicated that they had limited ability to buy RTCs from large facilities. While WSPA and the refineries that are subject to new BARCT argued strongly during the rule development process in 2008-2009 for the use of a shave methodology that was consistent with that used during the 2005 NOx RECLAIM amendment. During the later phase of the rule development process, they commented that staff should use the 2005 as baseline for the shave, not shave the 1.98 tpd RTCs converted from ERCs and portion reserved for Clean Fuel projects, and not set new BARCT for SRU/TGs and cement kilns.

Staff’s Response:

Because of the non-uniform emissions and RTC distributions in the SOx RECLAIM market (11 major facilities hold almost 90% of the RTCs and contribute more than 90% of emissions, and the remaining 21 facilities hold only 6% of the RTCs and contribute about 6% of emissions), a uniform percent shave cross the board is not the ultimate solution. The 21 facilities that have no equipment subject to the new BARCT cannot reduce their emissions further, cannot sustain operation since they had limited ability to buy RTCs from large facilities, and therefore cannot remain in compliance after the shave. To keep the 21 facilities active in the SOx market, staff is proposing to not shave the RTC holdings for these facilities if the RTC holdings are below their initial allocations provided to them at the start of the RECLAIM program. However, the amount of RTC holdings above their initial allocation will be shaved at the same rate as other 11 facilities and investors. With this approach, staff estimated that the 11 facilities will have a shave of 51.4%, 18 of the 21 facilities will be exempt totally from the shave, and 3 of the 21 facilities that have RTC holdings above their initial allocations will be shaved accordingly. Any trading from August 29, 2009 to the Governing Board hearing date will also be subject to the shave to ensure that RTC holdings are not inappropriately traded to or sheltered by a third party to avoid the shave.

California Environmental Quality Act (CEQA) Analysis

Pursuant to California Environmental Quality Act (CEQA) Guidelines §15252 and §15168 and AQMD Rule 110, the SCAQMD has prepared a Program Environmental Assessment (PEA) for proposed amended Regulation XX. Only the topics of air quality and hydrology (water demand) were identified in the Draft PEA as exceeding the SCAQMD’s significance thresholds. The Draft PEA was released for a 45-day public review and comment period from August 18, 2010 to October 1, 2010. Three comment letters were received from the public relative to the Draft PEA. Since the release of the Draft PEA, responses to the comments have been prepared and included in the document. Also, minor modifications have been made to the document. None of the modifications alter any conclusions reached in the Draft PEA, nor provide new information of substantial importance relative to the draft document. Further, the modifications do not constitute significant new information that would require recirculation of the Draft PEA pursuant to CEQA Guidelines §15088.5. Therefore, the document is a now a Final PEA and is included as an attachment to this Governing Board package.

Socioeconomic Analysis

The socioeconomic analysis of the proposed amended SOx RECLAIM was based on the 55 percent shave of SOx RTC holdings. Eleven facilities would be affected, the majority of which are located in Los Angeles County. The average annual compliance cost of the 55 percent shave ranged from $32 to $42 million with few job impacts on the local economy. The new proposed 51.4 percent shave would lower the compliance cost. The job impact of the new proposal would be within the noise of the economic model used for the SOx RECLAIM analysis. WSPA prepared its own socioeconomic analysis, including a scenario where a mid-size refiner closes. Staff reviewed this issue and pointed out a number of mitigating factors relative to any potential job impacts.

Implementation and Resources

It is expected that there will be a temporary workload increase due to applications submitted for installing new control equipment or retrofitting/modifying existing processes and there might be an increase in RTC trading activities. However, current AQMD resources are adequate to implement the proposed rule.

Attachment 1 (ZIP, 25m)

- Summary of Proposal

- Rule Development Process

- Key Contact List

- Resolution and Attachment 1

- Rule Language for PAR 2002 -

- Final Staff Report - SOx RECLAIM, Part 1 – BARCT Assessment & RTC Reductions Analysis, and Part 2 – Summary of Consultants’ Analyses

- Program Environmental Assessment

- Socioeconomic Analysis

Errata